Considering registering a Company in the USA from India?

The process can seem daunting, especially navigating unfamiliar regulations and paperwork from India. But I’m here to tell you how I registered for a US LLC from India within 14 days.

This guide details everything you need to know, from opening a US LLC, a bank account, and obtaining an EIN to acquiring a US phone number and mailbox. Don’t skip ahead, or you might miss valuable information. Let’s get started!

- Intro

- Why to Open a US LLC?

- What are the Legal Requirements for Foreign Entrepreneurs?

- What are the Key Steps for Registering a US LLC from India?

- How to Open an LLC for Non-US Residents?

- How Much Do US LLCs Charge Yearly?

- What You Need to Know About US LLC Taxation?

- How to Open a US Bank Account without SSN or ITIN?

- How to get a US Address?

- How to get a US Phone Number?

- Conclusion

- FAQ

Why to Open a US LLC?

Before jumping into the details of registering a US LLC from India, let’s explore why it might be a good option for you. Here are 3 key benefits:

1. Save on Currency Conversion Charges

If most of your earnings come in US dollars, you presently pay currency conversion fees to convert them to INR. By registering as a US LLC, you can manage your expenses in US dollars and only convert your profits. Depending on your income and expenses, this process can help you save around 10-15% of your earnings.

2. Ease in Doing Business

US LLC can help with affiliate marketing. Some programs (for example SiteGround, Jasper) only allow businesses from developed countries. Registering a US LLC lets you join these programs even if you’re abroad. It can also simplify things for dropshipping, e-commerce, and Clickbank.

3. Increase the Value of Your Services

Being a tech-friendly country with an attractive corporate taxation system and low costs for startups, the USA is one of the best options for opening a limited liability company (LLC).

Assume your client base is international. By being a registered US LLC, you might command somewhat higher fees compared to being an Indian organization.

Video Guide

Here’s a video guide on how I opened my LLC from India.

What are the Legal Requirements for Foreign Entrepreneurs?

To open a registered LLC in the USA from India, you’ll need to comply with certain legal requirements.

Passport

Passports are mandatory. They used to be optional for foreign entrepreneurs in the past. Now, your registered agent may need them to handle all formalities on your company’s behalf in the USA.

Unique Business Name

You’ll also need a unique business name. Search the official website of the relevant Secretary of State to check if there’s already a business established under the name you’ve chosen.

What are the Key Steps for Registering a US LLC from India?

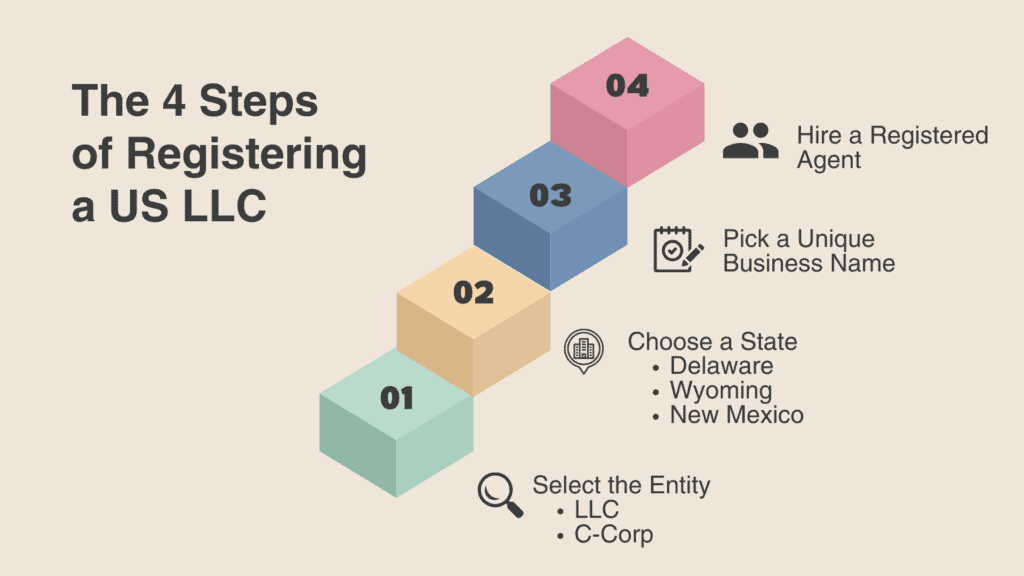

Registering as a US Limited Liability Corporation can be a lengthy process. However, I’m determined to simplify it for you as much as possible. There are several steps involved, from choosing a state to filing for an Employer Identification Number (EIN). Don’t be worried, let’s break down the process.

Step 1: Select the Business Entity

In the USA, there are specific ways to organize a business. As a foreign national, you have two popular options:

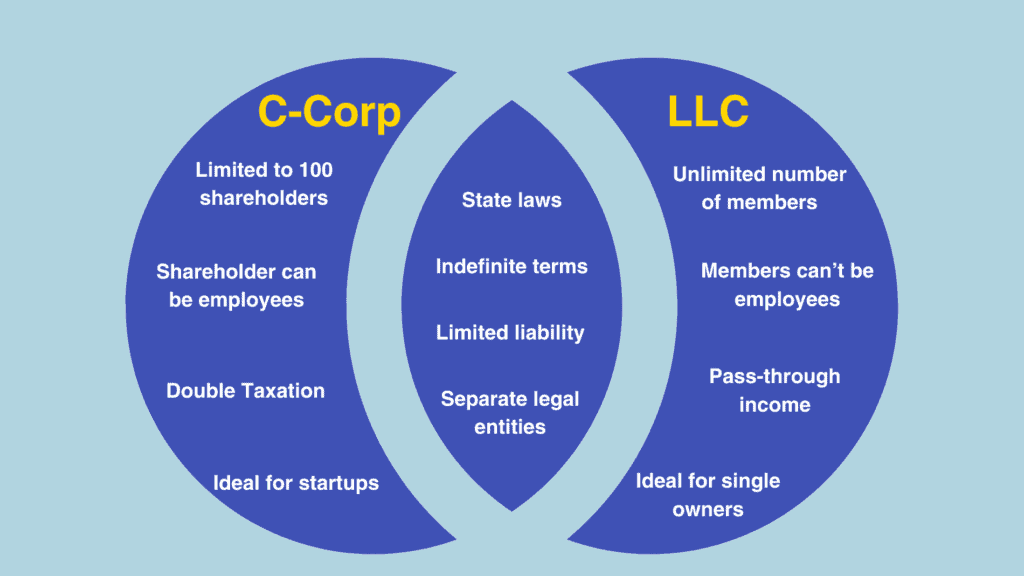

- Limited Liability Company (LLC)

Offers the simplest structure with flexibility in management. Owners (called members) can choose to be taxed like a C-Corp or pass-through taxation profits. Ideal for:

- Single owners

- Small partnerships

- Those seeking less record-keeping hassle.

- C Corporation (C-Corp)

A tax designation for corporations. Here, owners and shareholders are taxed independently. Profits and losses belong to the company and are taxed independently from the owner’s income. This structure is best for:

- Startups

- Fundraising

- Businesses with plans to go public.

While you might hear about S Corporations, these are limited to US citizens for tax. In my case, considering my business structure and requirements, I’ve chosen a US LLC.

Step 2: Choose a State

In the USA, there are three states that a majority of foreigners consider registering their businesses: Delaware, Wyoming, and New Mexico. Delaware is most popular for a C-corporation entity (C-corp), while New Mexico and Wyoming are known for LLC company registration.

Despite New Mexico boasting the lowest filing fee at just $50 with no annual maintenance charges, Delaware and Wyoming offer more business-friendly environments overall. Let’s explore which state might be the best fit for you between Delaware and Wyoming:

Similarities:

- No income tax if your business doesn’t have operations within the state.

- Quick and affordable incorporation process.

Delaware Advantages

- One of the strongest and most respected legal systems in the US.

- The Chancery Court in Delaware specializes in business disputes.

- 66% of Fortune 500 companies are incorporated in Delaware.

Wyoming Advantages

- Wyoming offers exceptional privacy protection. Your business name and address are not usually available in public databases.

- The annual filing fee in Wyoming is only $100, compared to $140 in Delaware. Other fees like business name reservation and annual franchise tax are lower.

In short, if strong legal protection and investor-friendliness are your top priorities, Delaware is the clear choice. But, if you’re a new business prioritizing privacy and affordability like me, Wyoming could be a better fit.

Step 3: Pick a Unique Business Name

As mentioned earlier, you’ll need a unique business name to register it in the American market. Choose the name thoughtfully, considering it will represent your brand and should be easy to remember.

You can use the Wyoming Secretary of State’s website to check if a business name is available. Just enter your desired name in the “filing name” field and hit search. If there are no similar registered businesses, you can proceed with the next step.

Struggling with Name Ideas? Don’t waste time brainstorming alone! We recommend using one of our top-rated AI business name generators to spark creative ideas.

Step 4: Hire a Registered Agent

A registered agent acts as a liaison between your business and the U.S. government. This agent, who must live in the state where your business is formed, is responsible for accepting legal services (important documents) on your company’s behalf. They will receive and forward all official mail and critical updates to your designated email address.

For non-residents, hiring a registered agent is mandatory to establish a business in the USA. The agent can provide valuable guidance in navigating legal procedures, ensuring timely responses to government notifications, and handling business license renewals.

How to Open an LLC for Non-US Residents?

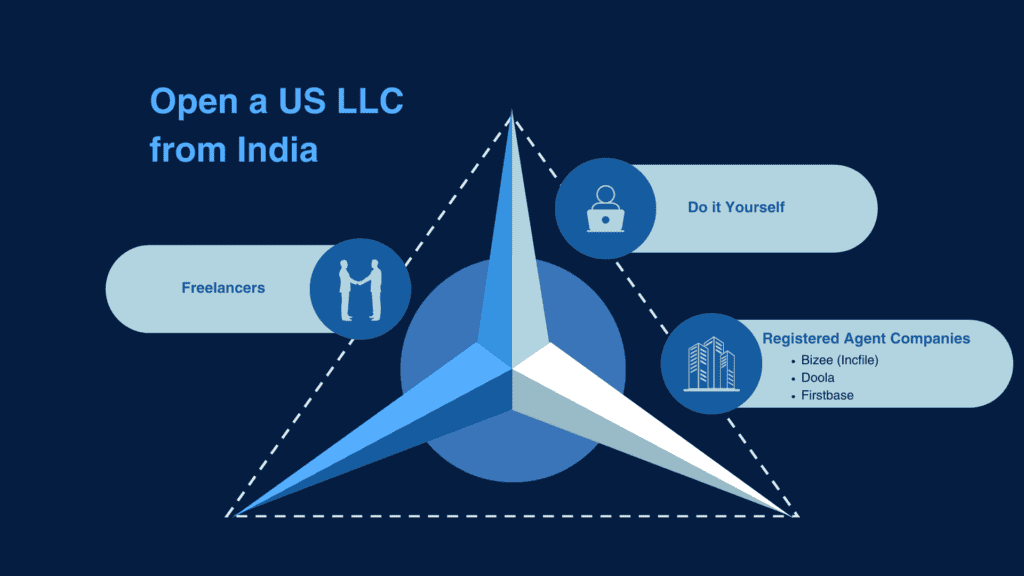

Now that you know the basic steps to register a company in the USA, we can delve into the actual procedures of the registration process. You have three options for registering your LLC:

Do it Yourself (DIY)

This option requires in-depth research and knowledge before proceeding. The entire process might be overwhelming for beginners.

Through Registered Agent Companies

Many companies in the USA can help you establish your LLC. Here are three viable options:

- Bizee (Incfile): A reputable organization with over 1 million customers, Bizee offers three packages Silver at $102, Gold at $301, and Platinum at $401, which include the Wyoming state fee. The Gold package includes getting an EIN but may take longer to process.

- Doola: Another reputable organization for business registration. However, their standard packages start at $297 per year, excluding state fees. Additional charges for customer service and financial management can make the total cost expensive.

- Firstbase: This popular option offers all-in-one services, including LLC company registration, tax filing, and bookkeeping. Packages start at $399 per year, with a mandatory $35 fee per month for a mailbox service. This makes it the most expensive option compared to the others.

- Through a freelancer

This can be a convenient option, especially if you find someone with expertise in registering LLCs in the USA from India. Freelancers can assist with various tasks, including LLC formation, getting a mailing address, and opening a bank account. Many freelancers even offer free consultation calls to discuss your needs.

In my case, the LLC formation process was completed within 3 days. I also received my EIN within 2 weeks, which is appreciably faster than the typical waiting time of 2-3 months from registered organizations. The total cost was around $301 (INR 25,000), which I found reasonable.

How Much Do US LLCs Charge Yearly?

A key consideration for non-residents registering a business in the USA is annual fees. These fees, necessary to maintain your LLC’s business compliance with the state, can be seen as annual maintenance charges. They generally cover annual report filing, registered agent services, and possibly other costs.

The total cost can range from around $85 to $300, depending on your chosen option, such as using freelancers or registered agent services. Freelancers may offer LLC formation and filing services for a flat fee, often within $100 annually. They help in annual return filing as well.

What You Need to Know About US LLC Taxation?

In the USA, an LLC is considered a pass-through entity. Pass-through entities pass their income on to owners and investors. Therefore, only the individuals, not the entity itself, are taxed on the revenues.

Therefore, you do not need to pay any state tax except for the annual registration fee in Wyoming. According to US federal tax law, non-residents do not need to pay any income tax if they do not have an established company in the USA or any employees living in the USA.

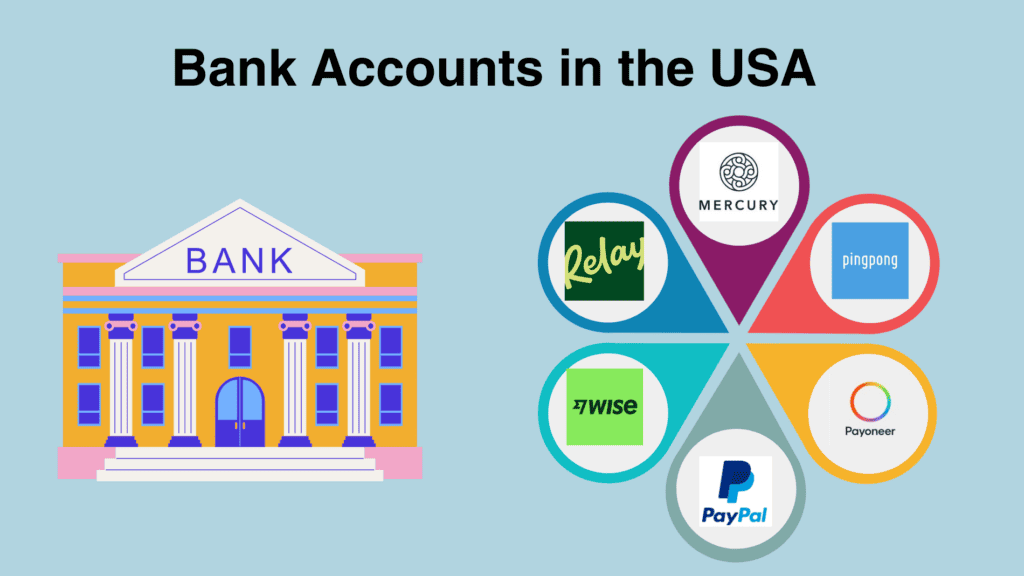

How to Open a US Bank Account without SSN or ITIN?

In order to conduct business transactions in US dollars, you must have a US bank account. Mostly, you will need three important documents: an established LLC, an EIN (Employer Identification Number), and a passport.

Here are some reputable banking organizations in the USA:

1) Wise

Wise is one of the most reputable platforms that offer international account facilities in over 70 countries. The best features of Wise are that it’s easy to set up, you don’t need a US number, and it offers excellent customer support.

To open a Wise account, you can use my link and enjoy a fee-free money transfer of up to INR 25,000. However, Wise does not offer debit cards, so you can only transfer money to your bank account for expenses.

2) Relay

If you need a debit card for international financial transactions, Relay is another good option to consider. Once you’ve set up your Wise account, you can open an account with Relay. It’s easy to set up, and you won’t incur any account fees or overdraft fees.

3) Mercury

After obtaining approval for both Wise and Relay, you can consider Mercury as the next option. However, be aware that the approval process for Mercury might not be as fast as Relay or Wise.

Here’s a tip: Once your Mercury account is open, go to Wise and set up an automatic transfer of $10 to your Mercury account. This might expedite the approval process. You don’t need to use a VPN in this case, as Mercury allows Indian IP address.

4) Pingpong

Are you into Clickbank, Dropshipping, or Ecommerce? Then, Pingpong is a good option for affiliate and performance marketers. Their best feature is that they offer virtual credit cards, something any other FinTech company hardly provides to US LLCs without an ITIN (Individual Taxpayer Identification Number).

However, the verification process is strict and lengthy. They verify every transaction detail, sometimes even asking for invoices and receipts. When I tried to open a PingPong account, they requested a lot of information to verify my identity. Since my Wise account and the other three accounts I mentioned weren’t active at that time, it might have been difficult for them to complete the verification process.

For that reason, I recommend opening a PingPong account after 2-3 months of activity in your other accounts. This will give them a transaction history to reference. To ease the verification process and get a point of contact, you can even open an account using my link.

5) Payoneer

Payoneer is another major platform for international transactions. They boast millions of customers, offer transactions in over 70 currencies, and operate in 190+ countries. You can quickly open an account using an Indian phone number. However, be aware that the verification process can be lengthy.

6) PayPal

Consider PayPal for your US bank account if you’re already freelance internationally. It works even if your clients don’t have PayPal accounts, but the approval process can be stricter than Payoneer.

An ITIN is usually required for approval, and without one, they may delay or reject your application. While I was fortunate to have my account approved with just an EIN, it’s not guaranteed.

These are useful options for international transactions. It’s important to remember that non-residents cannot open a physical bank account in the US without a Social Security Number (SSN) or ITIN.

However, if you need a Stripe account, registering your LLC with Stripe Atlas LLC can be a better option. Here’s why:

- You won’t need to pay any registration fees.

- You’ll benefit from quicker approval.

- You’ll receive one year of free card payment processing on Stripe.

I would also recommend using a premium VPN to browse the internet with a US IP address. Curious why? Learn all about VPNs (from A to Z) and how they can secure your online activities.

How to get a US Address?

Do you run an e-commerce, or dropshipping business, or need a US mailing address? While a registered agent might receive and forward your letters, documents, and parcels for the first year, you’ll likely need a permanent solution after that for receiving mail.

Here, I recommend virtual mailbox services like Anytime Mailbox. These services provide a physical address at over 2000 locations. You can receive mail and packages at this address, access your mailbox online 24/7, and have them forwarded or shipped to your location for a fee (around $10 per month).

The process to open an account with Anytime Mailbox is simple:

- Visit the Anytime Mailbox website.

- Select your desired location.

- Choose a plan and review the details.

- Pay the fee, and your mailbox is ready to use.

How to get a US Phone Number?

Is a US Phone Number Required to open a US LLC from India? This is a common question for businesses operating abroad. While a US phone number isn’t always mandatory, it can help open accounts in WhatsApp or Stripe, receive OTPs, and run e-commerce or dropshipping.

If you decide a US phone number is necessary, here are three options to consider:

1) KrispCall

KrispCall offers an affordable voice solution with no hidden fees. Their plans start at $15 per month and can go up to $40 per month for customized options. You can use features like messaging, WhatsApp, voicemail, and other standard functionalities.

2) OpenPhone

OpenPhone is another reliable option trusted by over 40,000 businesses worldwide. Their packages are marginally more expensive than KrispCall, starting at $19 per month. You’ll get one new local or toll-free number, unlimited calling and messaging to US and Canadian numbers, voicemail transcripts, and more.

3) TextPlus

Looking for a more affordable solution? TextPlus offers a free solution for SMS & MMS messaging to anyone in the US or Canada. However, this option might be better suited for businesses just starting out because of its limitations. For serious business operations, I wouldn’t recommend TextPlus because of potential reliability issues and server downtime.

Conclusion

To summarize, the USA has emerged as a popular destination for registering LLCs. By registering business here, you can save on currency conversion charges, ease of doing business, and increase the value of your services.

The business formation process is rather straightforward for non-residents. You’ll mostly need a passport and can work with a registered agent to handle the LLC formation. Costs vary depending on the chosen state and registered agent fees. Wyoming is presently considered a good option for privacy and affordability.

Last, I’ve provided a comprehensive overview of the process, including details on opening a US bank account, getting a mailing address, and having a phone number. I recommend reading the entire article before making any final decisions.

Hopefully, this guide will empower you to establish your first offshore business in the USA with ease. Best of luck!

FAQ

Can Non-Residents Open an LLC in the USA?

Yes! Non-residents can form LLCs in the USA. To register, you’ll typically need a passport and a unique business name.

Which state is better for LLCs?

Delaware, Wyoming, and New Mexico are popular choices for LLC formation. Delaware offers strong legal protection for businesses, while Wyoming is known for privacy and affordability.

How long does it take to open an LLC in the USA?

The LLC formation itself can be completed in 3 to 5 business days. However, getting an Employer Identification Number (EIN) can take anywhere from 2 weeks to 12 weeks. This timeframe depends on whether you’re opting for a freelancer or an organization.

What are the mandatory documents to open an LLC?

For non-residents, a passport is required to register an LLC in the USA. It’s best to check the specific requirements on the website of your chosen state’s Secretary of State.

What is the cost of opening an LLC?

The cost may be different based on whether you’re a freelancer or a company. If you hire a freelancer, the entire process will be completed within INR 25,000 currently.

What is ITIN? Is it mandatory?

An ITIN is an Individual Taxpayer Identification Number. In the USA, SSNs (Social Security Numbers) are assigned to track income and determine benefits. Similarly, an ITIN is for non-residents who need to pay taxes to the US government. However, with an ITIN, you can avail of credit cards or have a physical bank account in the USA.

Can you open a US bank account without a US LLC?

No, currently you cannot open a US bank account without a registered US LLC. Plus, you mandatorily need an EIN (Employer Identification Number).

Do you need to pay taxes in India?

Yes, if you transfer the profit to India, you may be required to pay income tax. The amount of tax you owe will be based on your income tax bracket and will be calculated on the taxable income you transfer to your Indian bank account, managing all your expenses in US dollars.

Are there any additional fees I need to bear to maintain my US LLC?

Yes, to maintain your US LLC, you will need to pay annual fees to your registered agent and annual report filing fees. The amount can vary from $85 to $300. However, for freelancers, it typically costs around $100 per year.